Bootstraps Tangled in Red Tape

Executive Summary

The burden of occupational licensing is stifling entrepreneurship in America. Unlike other studies that look at entrepreneurship generally, this study provides insight about the entrepreneurs who fall in the bottom portion of the income spectrum. It uses survey data from the Kauffman Foundation survey to first understand what low-income entrepreneurs look like and then how they are affected by the occupational licensing burdens that fall most heavily on them.

The average low-income entrepreneurship rate is 0.38{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}, or 380 entrepreneurs per 100,000 low-income residents. This is actually higher than the national average entrepreneurship rate overall for the year studied (0.30{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}). Yet, some states have a higher rate than average and some have a lower rate.

What can explain this difference? To answer that question, this study matches data from the Kauffman Foundation and the Institute for Justice for the first time ever and discovers a discernable connection between the percentage of low-income occupations licensed by a state and that state’s average low-income entrepreneurship rate. In particular, the higher the rate of licensure of low-income occupations, the lower the rate of low-income entrepreneurship. The states that license more than 50 percent of the low-income occupations had an average entrepreneurship rate that was 11 percent lower than the average for all states, and the states the licensed less than a third had an average entrepreneurship rate that was about 11 percent higher. Even after including control variables for demographic and economic factors that may explain the rates of low-income entrepreneurship, the association holds up and is statistically significant.

Reforms to state occupational licensing laws are vital to improving the rate of entrepreneurship among low-income workers. Those reforms should include the sunsetting of existing licensing arrangements and the creation of a private certification system to replace the current government-driven one.

This research was funded by the Ewing Marion Kauffman Foundation.

The contents of this publication are solely the responsibility of Grantee.

Introduction

A classic story defining the American experience is that of immigrants coming to the United States to find a better life and launch businesses of their own. Starting in the 1990s—first in California and then throughout the nation—Vietnamese immigrants began to set up manicurist businesses in record numbers, a feat not without its obstacles.1 The barriers these entrepreneurs faced are instructive. Indeed, they signal an important public policy impediment to the American dream that often goes unnoticed: the burden of government-required occupational licensing.

In a first-of-a-kind study published in 2006, economists Maya Federman of Pitzer College and David Harrington and Kathy Krynski of Kenyon College analyzed the trend, recognizing it as an ongoing natural experiment. The heart of the “experiment” lies in the fact that all states license manicurists, but each does so to varying degrees. For example, some have higher fees, while others have more stringent training requirements. Examining how the state requirements correlated to rates of self-employment by Vietnamese immigrants would yield valuable insight.

The researchers noticed that 6 percent of all Vietnamese workers were manicurists by the year 2000 compared to only 0.04 percent of the general population, meaning an astounding 42 percent of manicurists in the United States were Vietnamese immigrants. In addition, the authors discovered this group of immigrants shared a barrier to traditional employment common to other low-income entrepreneurs in the United States: 96 percent of adult Vietnamese immigrants had not graduated from high school.

Thus, the stage was set to see how state policies might influence the rates of entrepreneurship among a low-skilled group in a specific field encumbered by government requirements to obtain a license. As the researchers describe it, the required amount of training for manicurists varies considerably, ranging from 100 to 600 hours at state-approved cosmetology schools or via apprenticeships. Also, many states require manicurists to be either high school graduates or to have completed seven to 10 years of schooling.2

The study revealed that government policies had a powerful effect on the more than 300,000 manicurists included in the sample. Training requirements were the biggest determining factor in whether or not a manicurist eventually set up shop in a state. As the authors of the report concluded, the bigger the number of hours of required training, the smaller the number of Vietnamese manicurists – sometimes as low as nearly 18 percent below average.3

Citing health and safety reasons, states had been licensing manicurists long before the arrival of large numbers of Vietnamese immigrants, as noted by the authors. But the training hours required to secure a license appears excessive in most states, if the goal is to ensure health and safety. For example, the Colorado Sunset Commission argued that only 90 of the required 350 hours of training for manicurists in Colorado focused on health and safety issues.4 A growing body of academic literature and analysis has begun to make this general intuition undeniable, and new data sources are increasingly available on how such barriers to entry influence rates of entrepreneurship.

This study will focus on the impact of state occupational licensing on low-income entrepreneurs, and the detrimental effect of unreasonable regulatory barriers. The results should have consequences for any credible weighing of the costs and benefits of keeping the current legal regime that licenses occupations at the state level.

The Demographics of Low-Income Entrepreneurs

A number of studies—many of which will be cited throughout this paper—have focused on the importance of policy in influencing the rate of overall entrepreneurship in a state. Most of them yield important insights. However, their overall focus is not on the subset of entrepreneurs that fall within the lower-income brackets.5 Yet there is substantial evidence that the burden of certain public policies fall disproportionately on what might be termed “low-income entrepreneurs.”

To understand how public policy might influence the rate of entrepreneurship among this particular group, we need to understand who comprises it. Luckily, we have a wealth of data to look at, thanks to the Kauffman Foundation’s annual survey of entrepreneurial activity, a leading indicator of new business creation in the United States.6 The survey captures new business owners in their first month of significant activity through an analysis of matched monthly data from the U.S. Census Bureau’s “Current Population Survey.” In addition to this overall rate of entrepreneurial activity, the Kauffman survey presents separate estimates for specific demographic groups, states, and select metropolitan statistical areas. In fact, the Index provides the only national measure of business creation by specific demographic groups.7

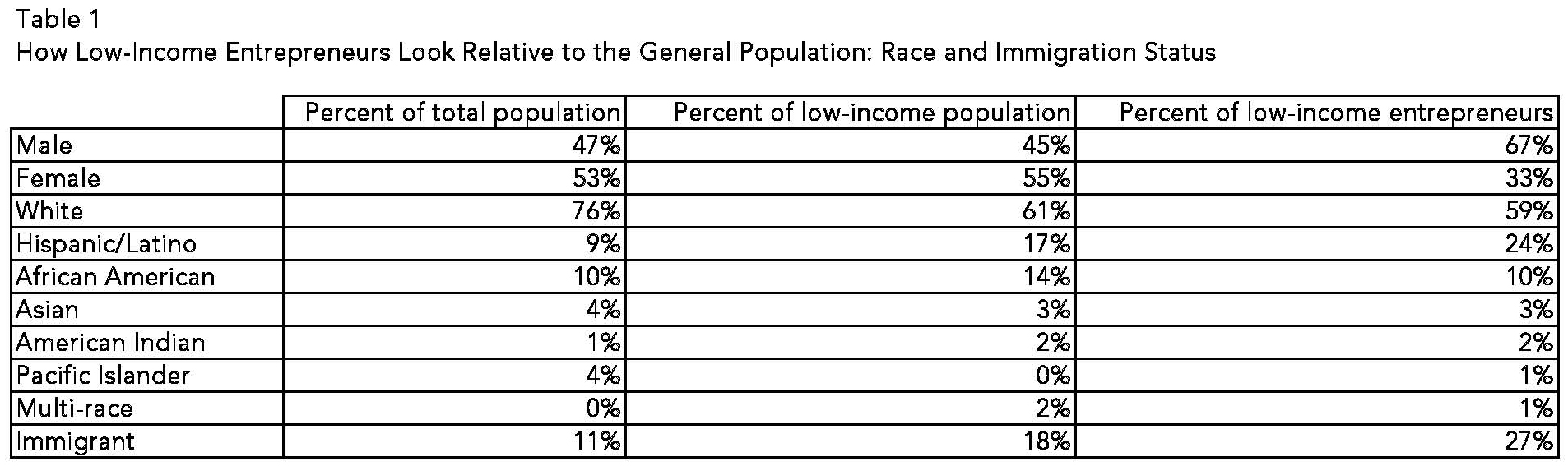

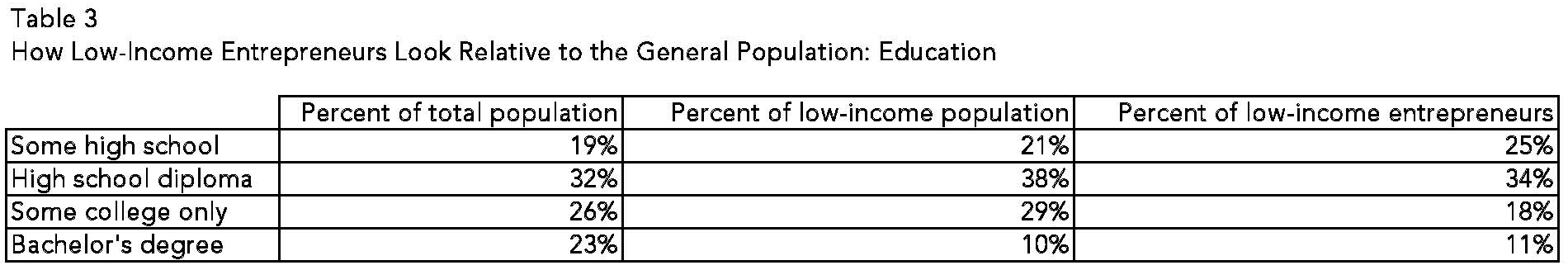

Using the Kauffman Foundation survey, we can derive some insight about the entrepreneurs who fall in the bottom portion of the income spectrum. The approach used here is to isolate in the broader survey the number of respondents who fit the definition of an entrepreneur but also fall within the two lowest- income quintiles by state.8 We can then compare their demographic characteristics to the general population. The results appear in Tables 1 through 3.

Source: Author’s calculations based on data from the Kauffman Foundation.

As seen in Table 1, while men make up 47 percent of the total population in the Kauffman Foundation survey, they make up a much larger portion (67{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}) of low-income entrepreneurs. African Americans, Asians, and American Indians are represented in the ranks of low-income entrepreneurs in roughly the same proportion as their numbers in the general population.

The most remarkable statistic is the rate of Hispanic low-income entrepreneurs. Though clearly the second-most dominant group in terms of total number of low-income entrepreneurs, they are only the third-largest group in the general population. In fact, the share of low-income entrepreneurs that are Hispanic is over 2.5 times the share of Hispanics in the general population. Thus, on average, any public policy that inhibits entrepreneurship opportunities for low-income workers by definition will likely burden Hispanics more heavily than other ethnic or racial categories.

The reason for such high Hispanic representation among low-income entrepreneurs is the fact that immigrants account for a much higher portion of all low-income entrepreneurs than their percentage of the general survey population would indicate (27 {010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f} vs 11{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}). The high representation of immigrant entrepreneurs—and Hispanic/Latino immigrants in particular—among all low-income entrepreneurs further helps illustrate the broader result that rates of entrepreneurship among immigrants as a general rule are higher than those of the native-born.9 The high rate of low-income entrepreneurship among Hispanics/Latinos is driving the rate of low-income immigrant entrepreneurs generally since they compose nearly 90 percent of all immigrant entrepreneurs.

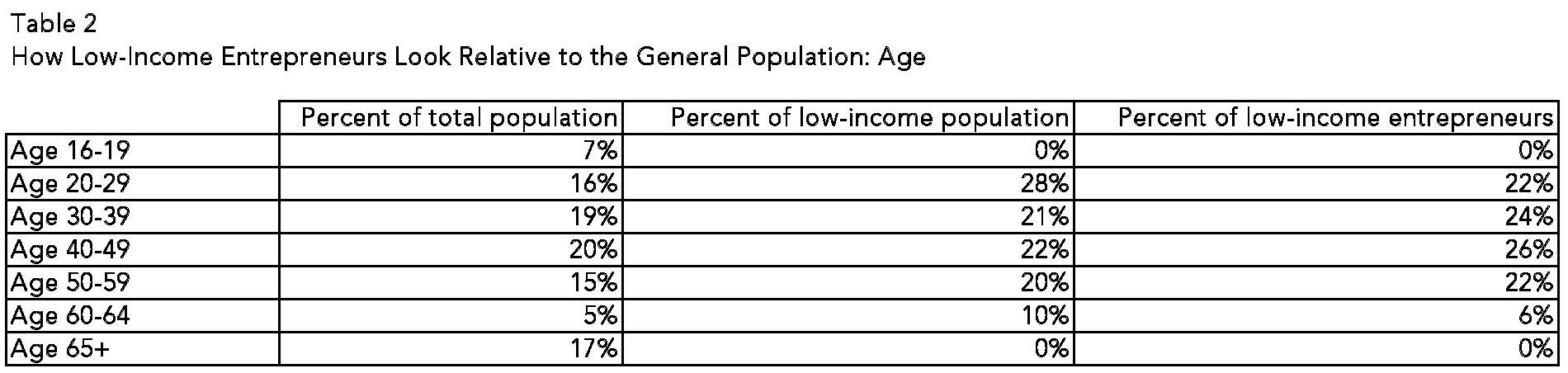

Source: Author’s calculations based on data from the Kauffman Foundation.

When it comes to the age of low-income entrepreneurs, the data show that half of all low-income entrepreneurs fall within the range of 30 to 49 years of age, meaning they are a slightly on average compared to that age range in the general and low-income populations (39{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f} and 43{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}).

Source: Author’s calculations based on data from the Kauffman Foundation.

Low-income entrepreneurs have generally less education than the general survey population, as seen in Table 3. While 49 percent of the total survey population and 39 percent of the low-income population have some college or a bachelor’s degree, only 29 percent of low-income entrepreneurs have the same amount of education. The reason for this, as we will see later, is that many of the fields of self-employment in the Kauffman survey are related to manual labor, particularly construction industries. While some of those fields require specialized knowledge and education, most of them do not. The high concentration of such opportunities for low-skilled laborers likely explains this lower-than-average level of educational attainment.

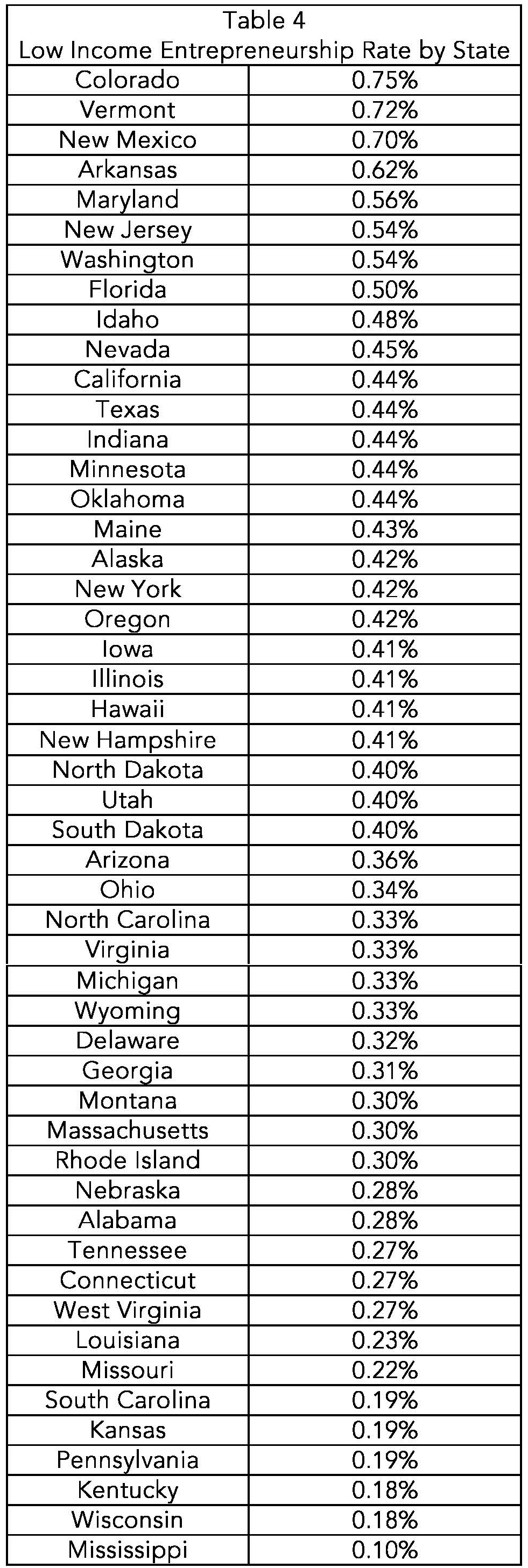

Once we’ve identified the low-income population in each state, we can calculate an entrepreneurship rate by dividing the number of low-income entrepreneurs by the number of total low-income respondents in the survey population. Table 4 ranks low-income entrepreneurship rates in states, from highest to lowest.

Source: Author’s calculations based on data from the Kauffman Foundation.

The average low-income entrepreneurship rate is 0.38 percent, notably higher than the national average entrepreneurship rate for the year studied (0.30 percent).10 The wide variation in entrepreneurship rates between states will be addressed later. In the meantime, it’s worth noting that six of the states in the top 15 of the low-income entrepreneurship rate (Colorado, New Mexico, Florida, Nevada, California and Texas) have twice as many Hispanics and Latinos in their populations than the national average. Other states within the top 15 (New Jersey and Washington) are a bit higher than the national average in terms of Hispanic/Latino population shares.

That these states would have this level of entrepreneurship among their low-income population is probably not surprising based on the fact that, as we’ve seen already, Hispanics and Latinos as a group have higher average rates of entrepreneurship than other racial or ethnic groups. What is interesting to ponder, however, is why a heavily Hispanic/Latino state like Arizona has a just-below-average rate of low-income entrepreneurship. The answer hinges on regulatory barriers that budding entrepreneurs face in a state. As will be discussed later in this paper, Arizona has one of the heaviest average occupational-licensing burdens for low-income entrepreneurs.11

How Entrepreneurship Helps Low-income People

Interest in entrepreneurship among low-income populations is neither new nor merely an academic curiosity. Indeed, one of the most important lessons from the past 20 years is how entrepreneurial activity offers an avenue out of poverty for many. As decades of studies show, entrepreneurs can be extremely effective in fostering local job creation and driving economic growth.12

Such cases are often found in low-income areas and immigrant communities. As Federal Reserve Bank of Kansas City economist Kelly Edmiston writes: “Entrepreneurship may yield a double dividend in low and moderate income communities. Many of the retail and services establishments available in higher income areas, such as grocery stores, often are not available to low and moderate income people … [who also] face transportation challenges. Entrepreneurial activity not only provides income to the entrepreneurs and perhaps others in the community, but also provides needed goods and services.”13

Some studies have noted that large shares of entrepreneurs are centered in industries that rely on low-wage workers—often the type of workers who find themselves below the poverty line, making those potential workers the most likely new hires for an entrepreneur.14 In addition, Edmiston notes that entrepreneurs themselves do not need to be low- and moderate-income people for the community to profit from a double dividend: “Benefits also arise from the location of entrepreneurial enterprises developed and operated by higher income people, but located in low and moderate-income communities.”

Some real-world examples come from the Initiative for a Competitive Inner City (ICIC), an organization that has tracked more than 600 companies in inner cities across the nation for 13 years.15 The ICIC list consists of companies located in 143 inner-city communities. To qualify, a company must have located at least 51 percent or more of its operations in economically distressed urban areas; must be an independent for-profit corporation, partnership, or proprietorship; and must have 10 or more employees and a five-year sales history. In other words, these entrepreneurs are committed to staying in poverty-stricken areas. By tracking the companies, ICIC paints a vivid picture of how entrepreneurship benefits poor communities and helps drive the employment that brings down a state’s poverty rate. ICIC estimates these firms have collectively created 70,000 new jobs over the past 13 years. On average, 37 percent of the workforce of those companies is from the local inner city.

The entrepreneurs identified by ICIC have become a force for stability and pride in these communities. Their average employee turnover rate was only 12 percent, less than one-third the national average. And company leaders have proven to be advocates for the communities in which they locate—an unsurprising finding considering that 77 percent of them have lived in the inner cities where the businesses were located.16

Other data corroborate this field study. University of Michigan’s Panel Survey of Entrepreneurial Dynamics indicates that 38 percent of “nascent entrepreneurs,” defined as those actively involved in the creation of new business ventures, live in low- and moderate-income areas. And around 45 percent of those live in low-income neighborhoods. In total, about 8 percent of “nascent entrepreneurs” live in households with below-poverty-level income.17

It is for these classes of families that entrepreneurial endeavors are the most important. Evidence of how entrepreneurship can be a ladder out of poverty comes from the Aspen Institute. Researchers there conducted a five-year survey in the mid-1990s, following more than 1,500 low-income entrepreneurs across the nation. Close to three-fourths (72{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}) of those low-income entrepreneurs experienced an increase in their household income between $8,000 and $22,374. Their household assets increased by an average of more than $15,000 over five years. Perhaps most impressive, more than half (53{010c6536f15f83a69f09c4467fdfb4a5656804feab27fe0dec71ed1e80da306f}) had moved out of poverty in five years. Additionally, those who were on welfare before becoming entrepreneurs were able to generate enough income on their own that, on average, the amount of public assistance they accepted declined by 61 percent.18

Economists have also tracked upward income mobility among low-income entrepreneurs and found the same general result. A seminal study published by the National Bureau of Economic Research in 2000 tracked the placement of low-income entrepreneurs in the income distribution over time. The authors concluded that, “in the sample as a whole, for individuals who began toward the bottom of the earnings distribution, continuous experience with self-employment was a successful strategy for moving ahead (relative to wage-earners), both in the short- and long-term.”19

Impediments to Low-Income Entrepreneurship

Although the benefits of entrepreneurship to business creators, their employees, and communities are well established, it is becoming more obvious that those who can most benefit from rising levels of entrepreneurship—low-income households—face unique impediments that fall harder on them than other budding entrepreneurs. For example, high-tech fields that drive innovation, many of which consist mainly of small start-up firms, do not require any sort of licensing or, for that matter, a college degree. (The well-known example of successful tech companies started by college dropouts is relevant here.) On the other hand, occupational fields that contain the most likely entrepreneurial opportunities for low-income workers are among the most heavily regulated in terms of state-required licensing and experience or degree requirements. Additionally, low-income entrepreneurs are likely to have less access to capital to get their businesses off the ground than other types of firms.

Lack of Access to Capital

One of the most widely acknowledged impediments to entrepreneurial endeavor among low-income households is lack of access to capital. For instance, entrepreneurs further up the income spectrum can take out business loans by pledging their homes as collateral. States differ in the particulars of bankruptcy statutes that treat primary homes differently with respect to creditors. In states offering more generous protections of someone’s home from creditors, entrepreneurs are likely to take on more risk in the creation of a business, and more people overall are likely to take on even a small amount of risk.

The research on bankruptcy-code differences between states supports this theory. Entrepreneurship levels have shown to be significantly higher in states with more generous homestead exemptions after adjusting for a number of other factors that may explain the phenomenon.20 However, low-income families are much less likely to own a home and won’t have the same easy access to capital, so this avenue to a business loan is unlikely to be open to them.

Occupational Licensing

Occupational licensing is, broadly defined, a state government requirement that a worker within a certain profession obtain a state-issued license. It usually requires tests for competency, experience, and education requirements, and often a number of fees. Some states license more occupations than others, and two states that license the same occupation may do so to differing degrees; they may have lower or higher education thresholds or lower or higher fees, for instance.

Some occupational categories—doctors, lawyers, and nurses, for example—are licensed by every state, and there is general agreement that such licenses can protect the safety of the public. But licensing other occupations—such as interior design and hair styling—is more controversial.

Researchers have increasingly become concerned about the degree to which a state’s licensure regulations have become too onerous as well as the proliferation of occupational categories now requiring a government-issued license. There is a general knowledge of how expanding occupational licensing regimes have changed and harmed the labor market in the United States. As Morris Kleiner and Alan Kreuger, two of the foremost scholars on this issue, have noted, in the early 1950s only about 5 percent of workers were covered by state licensing laws. Today, that number exceeds 20 percent of workers.21

Policymakers over the past few decades have rationalized that the growth of government licensing is necessary to protect the health and safety of the public at large. But the most robust explanation—which also explains the persistence of state licensing regimes—is that occupational licensing serves the purposes of keeping out new competitors. As such, it is favored mainly by incumbent businesses for that sole purpose. In truth, the health and safety justification rarely holds up under scrutiny.22 In cases where the policies have been studied, there is scant if any evidence that they enhanced the public’s safety.23

What has held up under analysis is that those working within the licensed professions effective at keeping out competitors are enjoying many benefits. After adjusting for a number of factors such as education, experience, and industry category, Kleiner and Kreuger have been able to measure a clear “licensing premium.” Their research suggests that those who hold licenses within licensed professions have 15 percent higher wages than those in unlicensed professions.24

When businesses never get started in the first place, resulting in fewer competitors in the marketplace, society pays a price. Estimates of the cost, what economists Kleiner and Kreuger call “deadweight loss,” range from $34.8 and $41.7 billion per year (in 2000 dollars), compared to a labor market without licensing.25

Another troubling side effect of occupational licensing relates to income inequality. Morris Kleiner asserts that licensing may increase wage inequality in two ways: first by keeping people from entering higher-wage occupations, and then by raising wages for those already in high-income occupations. In addition, he notes that highly educated and influential occupations may be more powerful in local jurisdictions and thus able to control supply more effectively: “Since occupational licensing appears to increase earnings, on average, for persons in high-income occupations relative to persons in low-income ones, this state and local policy may serve to exacerbate income dispersion in the United States.”26

How Occupational Licensing Hinders Low Income Entrepreneurship

Most of the studies published to date have focused on the overall licensing burden.27 Only a few have tried to focus on the effects these burdens have on low-income occupations particularly.

The most advanced attempt to measure the occupational licensing burden on low-income occupations was published in 2012 by the Institute for Justice.28 Using data from the Bureau of Labor Statistics and the Department of Labor, the authors compiled a list of occupations ranked by average income. They excluded from the list those occupational categories that were most heavily represented by workers with above-average income, leaving only occupational categories that were most heavily composed of middle- and low-income earners. That left 102 specific occupational categories out of a total of nearly 800.

Then the authors compiled occupational licensing data for all 50 states – ranging from whether a state licenses the occupation or not, the fees charged to obtain a license, and education and experience requirements. Finally, they assigned scores to the states and ranked them based on the comparative heaviness of the licensing burden. So, for instance, a state that requires a bachelor’s degree, three months of experience and a $250 fee to obtain a license to work in a specific occupation received a higher score—indicating they have a heavier licensing burden—than a state that did not have any education or experience requirements and only a $50 fee. States that licensed fewer occupations got generally lower scores and ranked lower. In this particular ranking, being on the bottom is a good thing.

This research endeavor yielded some interesting insights for anyone hoping to further explore the burden of occupational licensing on lower-income workers. The report’s executive summary recounts them as follows:

“The 102 occupational licenses studied require of aspiring workers, on average, $209 in fees, one exam and about nine months of education and training.”

“Thirty-five occupations require more than a year of education and training, on average, and another 32 require three to nine months. At least one exam is required for 79 of the occupations.”

“Interior designer is the most difficult occupation to enter, though it is licensed in only three states and D.C. Taking into account how many states license an occupation, cosmetology trades (cosmetologist, barber, skin care specialist and manicurist), truck and bus drivers, and pest control applicators are among the most widely and onerously licensed occupations.”

“Louisiana licenses 71 of the 102 occupations, more than any other state. Arizona licenses 64, California 62 and Oregon 59. Wyoming, with a mere 24, licenses the fewest, followed by Vermont and Kentucky at 27. On average, states license 43 occupations.”

“Hawaii has the most burdensome average requirements for the occupations it licenses, while Pennsylvania’s average requirements are the lightest.”

“Arizona and California rank as the most widely and onerously licensed states, with a large number of licensed occupations and burdensome requirements.”29

The Institute for Justice study also illuminates the arbitrary nature of many of these restrictions. As the authors summarized:

“Most of the 102 occupations are practiced somewhere without government permission and apparently without widespread harm: Only 15 are licensed in 40 states or more, and on average, the 102 occupations are licensed in just 22 states—fewer than half. This includes a number of occupations with no self-evident rationale for licensure, such as interior designer, shampooer, florist, home entertainment installer and funeral attendant.”

“Licensure burdens often vary considerably across states, calling into question the need for severe burdens. For instance, while 10 states require four months or more of training for manicurists, Alaska demands only about three days and Iowa about nine days.”

“The difficulty of entering an occupation often does not line up with the public health or safety risk it poses. For example, 66 occupations have greater average licensure burdens than emergency medical technicians. The average cosmetologist spends 372 days in training; the average EMT only 33.”30

How Occupational Licensing Hinders Low-Income Entrepreneurship

This variation in policy regimes gives researchers the opportunity to study a grand natural experiment and ask a very important question: If states have different levels of occupational licensing burdens, how does that influence the actual amount of low-income entrepreneurship seen in each state? This study is an attempt to bridge what we know about occupational licensing burdens and the surveys of the Kauffman Foundation—particularly their “Index of Entrepreneurial Activity”—and give a preliminary answer to that question.

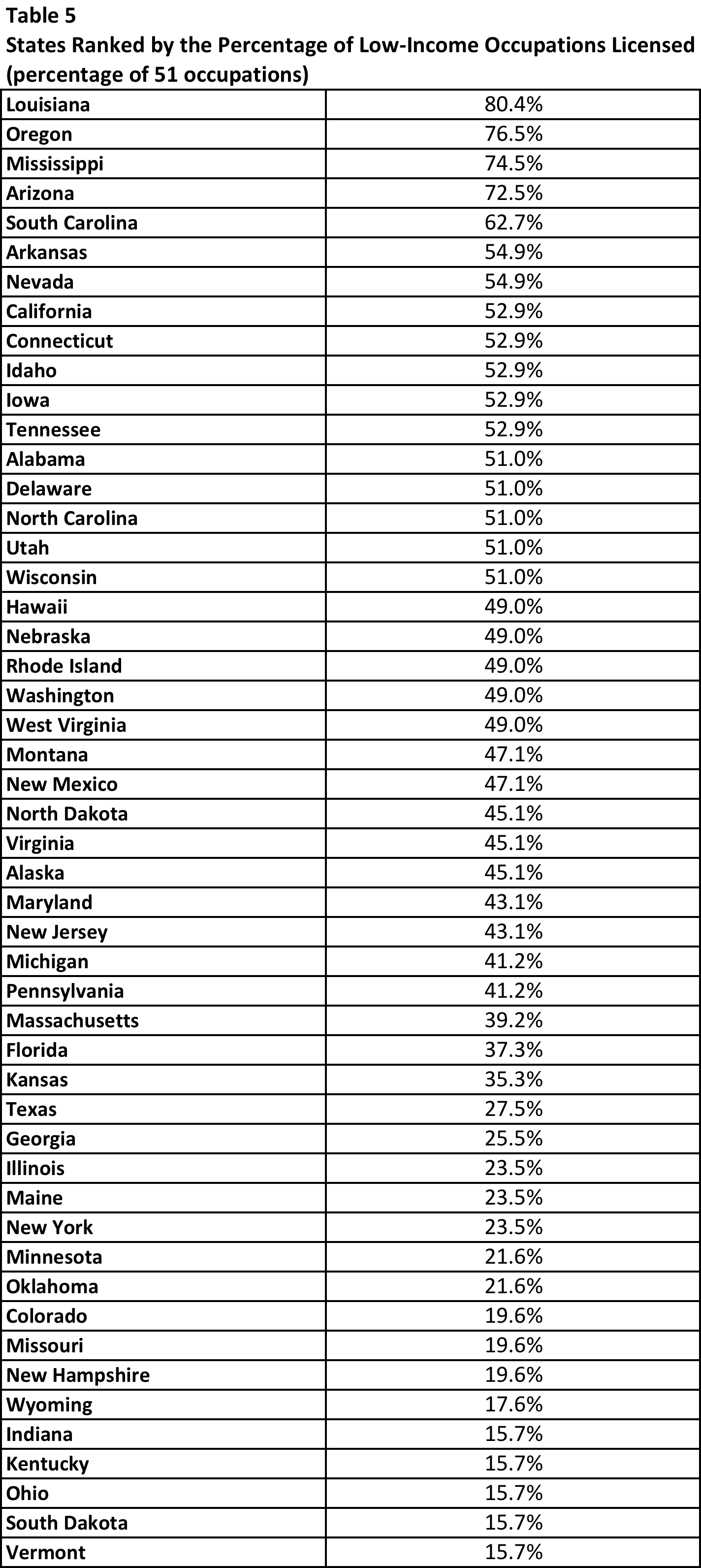

In answering this question, the first step was to make sure that the Institute for Justice data matched the occupations represented in the Kauffman survey. A couple of insights about both datasets are important here. The list of low-income occupations tended to be heavily service-oriented. Yet not every service occupation that appears in the Institute for Justice study appears among the survey respondents in the Kauffman data on which the low-income entrepreneurship rate in Table 4 above is based. Therefore, the Institute for Justice ranking of the number of occupations licensed by each state was recalculated based on the service occupation categories common to each dataset. That new ranking appears in Table 5. The list of the occupational titles appears in Appendix B. The final total in this matched sample was 51 occupational titles—about 48 percent of Institute for Justice’s 107 total included occupations.

Source: Author’s calculations based on data from the Institute for Justice.

There is a heavy concentration of low-income workers in the construction-related occupational categories in both the Institute for Justice sample and our sample. They account for a substantial number of the occupational titles—roughly a third in the Institute for Justice’s sample and 51 percent in the modified sample used for the analysis in this study. This will have a tangible effect on the entrepreneurship rate since many workers within the construction industry operate as independent contractors.

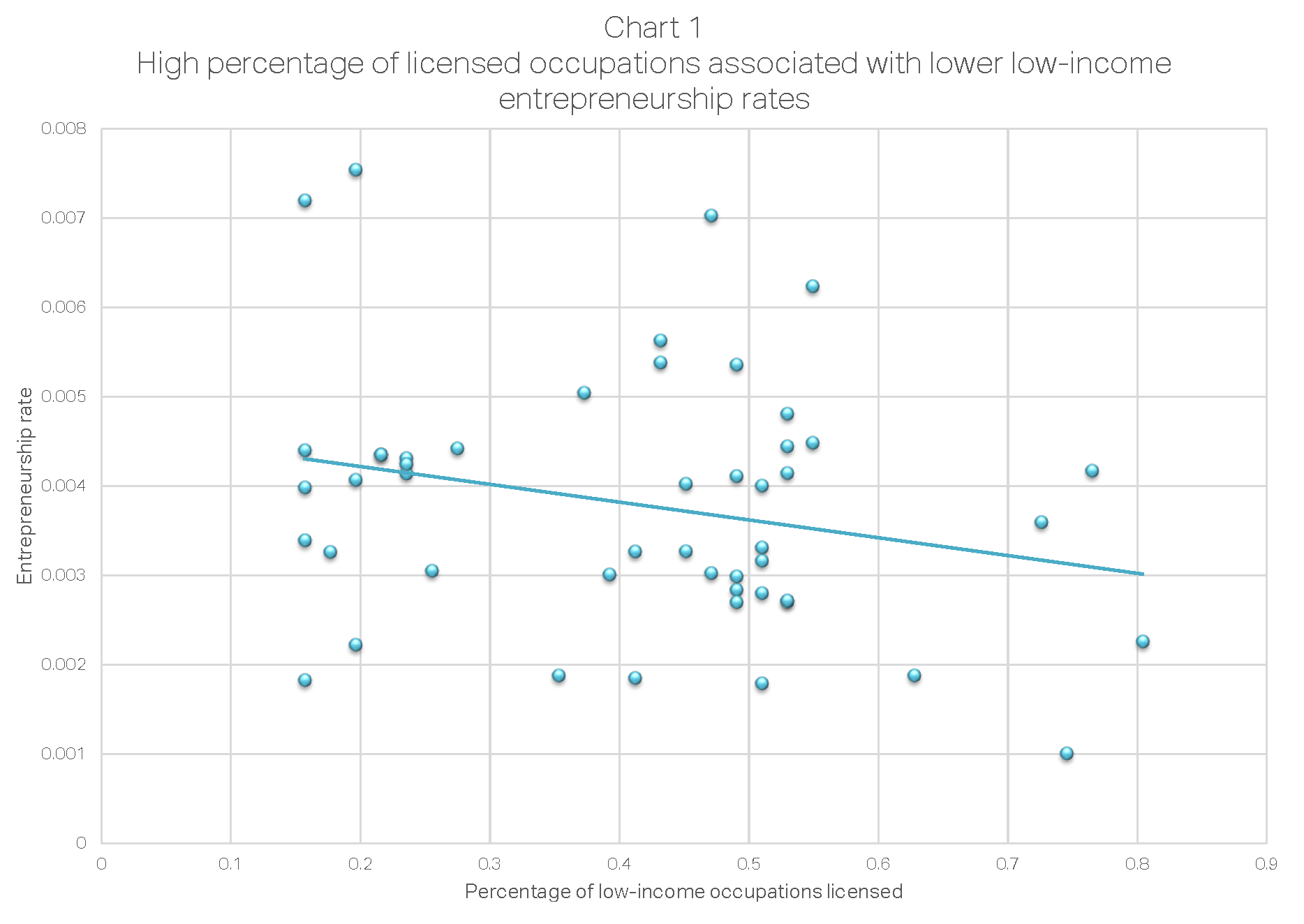

Paring down the list of occupations in the Institute for Justice study to more closely match those in the Kauffman survey results allows us to see a correlation between the scope of occupational licensing and the level of entrepreneurship among low-income populations. As shown in Chart 1, there is a discernable connection between the percentage of low-income occupations licensed by a state and that state’s average low-income entrepreneurship rate. In particular, the higher the rate of licensure of low-income occupations, the lower the rate of low-income entrepreneurship.

Source: Author’s analysis based on data from the Institute for Justice and the Kauffman Foundation

To make the correlation easier to understand, let’s look at some specific numbers. As shown in Table 5, no state licenses less than 15 percent of the low-income occupations. But there is wide variation in the states at the top and the bottom of the ranking. The bottom third of all states license less than a third of the low-income occupations, while the top third of all state states license more than half. Some license an unusually high percentage—Arizona, for instance, licenses nearly three-quarters of all low-income occupations in our sample.

As such, the differences in entrepreneurship rates are striking: the states that license more than 50 percent of the low-income occupations had an average entrepreneurship rate 11 percent lower than the average for all states, and the states the licensed less than a third had an average entrepreneurship rate about 11 percent higher.

These results indicate that the mere presence of widespread occupational licensing can depress the low-income entrepreneurship rate. This might seem strange until you consider the barriers that many low-income entrepreneurs face. As we have seen, many of them don’t have a high school diploma and even fewer have a college degree, both of which make white-collar work harder to obtain. If a state licenses nearly all of the occupations listed in this study, there is no escape from potentially excessive occupational licensing regulations for low-income people. In a state that licenses only 15 percent or 20 percent of low-income occupations, then more professional substitutes are open to this population.

Subjecting the above correlation to statistical testing shows that the relationship between broader occupational licensing and lower-than-average levels of low-income entrepreneurship holds up even after accounting for other variables that might explain the data. After adjusting for factors such as the age of the population of a state, the unemployment rate, the presence of a large Hispanic/Latino population, the prevalence of construction employment in the economy, and the percentage of the population that is male—all of which have been shown in this paper to be important demographic factors that distinguish low-income entrepreneurs from the general population—the presence of widespread occupational licensing in a state has a statistically significant negative effect on the rate of entrepreneurship in a state. (More detailed results are included in Appendix A.)

It’s certainly possible that a state regulating only a handful of occupations does so in a punitive fashion. The fees could be astronomical, or the state could require years of education and training before an entrepreneur can set up shop. The Institute for Justice study has tried to take that into account by assigning a score to each occupational requirement and then summing those scores across occupations and then summing them across states.31

Additionally, the Institute for Justice analysis concluded that the education/experience requirements were the most difficult for low-income entrepreneurs to overcome. The analysis in this paper also indicates this reasoning is likely correct.

To make these education/experience scores comparable to the Institute for Justice data and the Kauffman survey, they were recalculated for our smaller occupational sample. In addition, the scores were rescaled (on a scale of 0 to 2) to make them easier to compare. Lower scores—i.e., those closer to zero—indicate a more stringent licensing environment, while a high score indicates a less stringent one. The resulting analysis indicated that, on average, states topping the list for scope of licensing also had lower requirement scores which, in our method of ranking, is indicative of more stringent licensing requirements.32 The average score for the states that license more than half of low-income occupations had a stringency score that was over 16 percent lower than the national average (1.18 vs. a 1.42 national average). Those states with a lower percentage of occupations licensed (under 30 percent) had a score that was around 16 percent higher than the national average (1.63 versus 1.42). In other words, there is at least some evidence that states which license more occupations also demand more education and experience requirements to obtain a license. In addition, because the states that license a larger share of low-income occupations also tend to have lower rates of low-income entrepreneurship, this indicates that education and experience requirements may have some negative impact on the overall low-income entrepreneurship rate.

Policy Recommendations

Entrepreneurship among low-income households has been shown in numerous studies to be an effective means of alleviating poverty and encouraging income mobility. Policymakers would be well advised to advance a course of action that increases the potential for low-income entrepreneurship as one important tool in increasing prosperity and reducing poverty.

In addition, it has also become clear that raising the barriers to entry for specific occupations, even with the best of intentions, may hinder low-income entrepreneurship. That has become the case with state government enactment of occupational licensing requirements. Thus, any state policymakers looking for an obvious lever to pull to make their state business climate more conducive to entrepreneurship generally—and low-income entrepreneurship in particular—should look closely at the occupational licensing regime in their state.

Broad-based reform of occupational licensing is a good idea from this perspective. Incremental reforms can help achieve part of this goal. Requiring a review and potential sunset of all occupational licensing laws would put the burden of proof on those who advocate extending them and require them to prove the benefits of the regulations outweigh the costs, which should include the lower level of new business creation that results from these regulations. Over time, it may become more obvious through such a review process that the health and safety regulations have outlived their usefulness, particularly in the face of new technologies. Sunsetting entire classes of occupational licenses could provide some relief to specific sectors.

While the sunsetting of existing regulations would likely be a beneficial policy to all, the problems facing low-income entrepreneurs are in many ways unique. Most are likely to set up service-based businesses—one of the most frequently regulated types of businesses—but they are also more apt to possess a lower level of education than the general population. This barrier isn’t easily overcome if education or experience remains a means to prevent low-income entrepreneurs from obtaining occupational licenses.

A better broad-based reform would allow a more decentralized form of achieving the beneficial goals of occupational licensing—basically, allaying the public’s concerns about health and safety—while simultaneously providing a mechanism that can experiment with the best ways of certifying someone in a trade or acknowledging types of experience that may not be currently recognized by a state licensing agency or state law.

A regime of voluntary private certification would fit this bill.33 In such a system, the role of judging the soundness and capability of someone to provide services would fall to private entities—probably independent nonprofit organizations like the Better Business Bureau, but possible legal arrangements could allow room for for-profit certifiers as well.

A key element here is that these organizations would not be able to prohibit someone from practicing an occupation. The legal regime would instead prohibit anyone from claiming a certification they do not have. In addition, this legal regime would also create a private market for certifiers and an incentive within that market for private certifiers to police themselves, one another, and the industries they monitor.

For example, as Goldwater Institute economist Byron Schlomach explains, the government does and should have the power to sue or prosecute for fraud if someone lies about having a certification. “If someone claims a certification falsely but the certification requires no bona fide minimum standards other than paying a fee for someone to belong, the government can and should refuse to protect the certifying organization’s rights.” This would create an incentive for the certification industry to monitor themselves: “Private professionals will have an incentive to band together and create professional standards outside of government as long as they know their efforts will be protected without necessarily going through the high costs of civil litigation.”

In addition, a competitive private certification system would alleviate the biggest problem faced by low-income entrepreneurs: arbitrary education and experience requirements written by representatives in incumbent industries who wish to keep out competitors. The incentive to use government policy to quell competition is an inherent feature of occupational licensing as it currently exists in the states. One way of doing this is to set the experience hurdle high enough for current practitioners to clear but too high for those seeking entry into the industry. These barriers are all the higher for low-income entrepreneurs who may, according to the government-written standards, have to do more than just take a competency test—they may be required to spend a great deal of money and time to get a certain type of degree first.

Now consider the incentive of a private certifier. They have an interest in a large number of practitioners carrying their certificate while still keeping the integrity of that certification high. Think of it as a market for reputation where both the certifier and certificate holder have an incentive to make sure their reputations remain sound. Meanwhile, it’s likely that the level of expertise needed to maximize public safety and health that also weighs the costs of certification—in both time and money to the certificate-seeker—would be lower than what many occupational licensing statutes currently mandate.

In addition, certifying agencies are likely to come up with more creative ways of testing competency. The matter may simply come down to requiring their certificate-holders to pass a test each year, independent of whether they have a degree or not. As long as the applicants have studied or proven their experience level somehow to a certifier who is concerned about maintaining a professional reputation and not about keeping people out of an industry, the public is likely to be better served.

The incentives built into the system would also serve to keep licensing fees low, and potentially much lower than the current licensing fees in some states. Competition between certifying firms is likely to keep fees to license seekers close to the cost of issuing and enforcing those licenses. Any higher, and a certifying firm would risk competition from an equally reputable but lower-cost alternative. The current incentive built into the occupational licensing system is not based on such competitive price pressures but rather by the interests of incumbent firms—or, in the case of a state government budget system that sees fee revenue as fungible, the demands of budget year politics. In either case, the public and the license-seeker are not served but the incumbent firms certainly are, as it is they who are likely to be able to pay the higher fees and who set them to keep out startups in the first place.

Conclusion

The two reforms proposed here can also work together over time. The private certification option can exist for any occupation that is not currently licensed. The sunset review requirement, however, can create an environment in which the default assumption could be a transition to the private certification system unless there are strong and compelling reasons not to do so. It is likely that professions with a high degree of public concern over effectiveness and safety—such as medicine or law—will remain generally the purview of government certification. Others may, over time, be phased out in favor of the new system after a cost-benefit analysis is conducted. Additionally, a sunset process can assist with a gradual transition to allow a market for private certifiers to develop and mature.

As the analysis in this study indicates, lowering certification barriers to entry is likely one of the best ways to encourage more entrepreneurial endeavors among low-income households. Policymakers may not have much capability to alleviate all the challenges that low-income entrepreneurs face but they can certainly exert a great deal of leverage on the regulatory hurdles they do control. Reform of the existing occupational licensing regime is arguably the most important action they can take.

Appendix A: Empirical Results

The empirical estimates cited in this paper come from an ordinary least squares (OLS) regression model designed to gauge the influence of a number of demographic and policy variables on the rate of entrepreneurship. The model is cross-sectional and uses data from all 50 states for the year 2007.

The dependent variable was the low-income entrepreneurship rate that was calculated by dividing the number survey respondents who self-identified as entrepreneurs in the Kauffman Foundation survey but who also fell within the bottom-two income quintiles by the total number of low-income respondents in the survey.

The year 2007 was chosen for the analysis for the purposes of decreasing the influence of “necessity entrepreneurs” in the analysis. Necessity entrepreneurs are those who may be self-employed because there are no other traditional employment options available but who would rather be working in such traditional employment if given the chance. This type of entrepreneur is more likely to be prevalent during a recession than during a boom period. Therefore, a year that is near the high-water mark of a boom cycle is likely to yield fewer of these types of observations.

Data for the regression comes from the Census Bureau, the Bureau of Economic Analysis, the Bureau of Labor Statistics, the Institute for Justice, and the Kauffman Foundation.

The results of the OLS regression analysis are below. They indicate that a state’s level of licensure of low-income occupations has a significant effect on the overall level of low-income entrepreneurship. Based on the coefficients, the share of a state’s population composed of Hispanics and Latinos, the median age, and the percentage of males in the population also has a significant effect on the level of low-income entrepreneurship, as expected. However, the scope of occupational licensing and the percent of Hispanics and Latinos in the state’s population had greater explanatory power based on their t-scores.

The unemployment rate had a sign different than expected—the basic hypothesis put forward in this paper would seem to predict a positive sign on the unemployment variable since necessity entrepreneurship thrives best in an environment of high unemployment. However, upon further reflection, choosing 2007 may explain the negative correlation since it was a period that included many alternative employment opportunities. Including the unemployment variable is important to adjust for the general macroeconomic conditions of a state. The results here indicate that, on average, a state with a low unemployment rate had a higher rate of low-income entrepreneurship. This seems to indicate that the states with high rates of low-income entrepreneurship in this analysis are not necessity entrepreneurs at all, but instead are “opportunity entrepreneurs” who are starting their own businesses even though the healthy economy is providing ample alternative opportunities in traditional employment.

Coefficient T-stat

Constant* -0.0215 -1.30

Unemployment rate* -0.0244 -1.32

Male percent of population* 0.04434 1.45

Median age* 0.00013 1.35

Percentage of jobs in construction -0.00014 -0.03

Share of licensed occupations** -0.00198 -1.86

Hispanic/Latino percent of population*** 0.00708 3.65

R-squared = 0.35

* – significant at the 90 percent level

** – significant at the 95 percent level

*** – significant at the 99 percent level

Appendix B: Occupational Categories Included in the Analysis

- Animal Breeder

- Barber

- Carpenter/Cabinet Maker Contractor (General/Commercial)

- Carpenter/Cabinet Maker (Residential)

- Cement Finishing Contractor (General/Commercial)

- Cement Finishing Contractor (Residential)

- Child Care Worker

- Cosmetologist

- Door Repair Contractor

- Drywall Installation Contractor (General/Commercial)

- Drywall Installation Contractor (Residential)

- Electrical Helper

- Farm Labor Contractor

- Fire Alarm Installer

- Floor Sander Contractor (General/Commercial)

- Floor Sander Contractor (Residential)

- Glazier Contractor (General/Commercial)

- Glazier Contractor (Residential)

- Home Entertainment Installer

- Insulation Contractor (General/Commercial)

- Insulation Contractor (Residential)

- Interior Designer

- Iron/Steel Contractor (General/Commercial)

- Iron/Steel Contractor (Residential)

- Landscape Worker

- Manicurist

- Mason Contractor (General/Commercial)

- Mason Contractor (Residential)

- Mobile Home Installer

- Nursery Worker

- Painting Contractor (General/Commercial)

- Painting Contractor (Residential)

- Paving Equipment Operator Contractor

- Pipelayer Contractor

- Pipelayer Non-contractor

- Earth Driller

- Shampooer

- HVAC Contractor (General/Commercial)

- HVAC Contractor (Residential)

- Sheet Metal Contractor (General/Commercial)

- Sheet Metal Contractor (Residential)

- Skin Care Specialist

- Taxi Driver/Chauffeur

- Terrazzo Contractor (General/Commercial)

- Terrazzo Contractor (Residential)

- Fire Sprinkler System Tester

- Backflow Prevention Assembly Tester

- Cross-connection Survey Inspector

- Tank Tester

- Tree Trimmer

- Truck Driver

Get Connected to Goldwater

Sign up for the latest news, event updates, and more.

Recommended Blogs

Donate Now

Help all Americans live freer, happier lives. Join the Goldwater Institute as we defend and strengthen freedom in all 50 states.

Donate NowSince 1988, the Goldwater Institute has been in the liberty business — defending and promoting freedom, and achieving more than 400 victories in all 50 states. Donate today to help support our mission.

We Protect Your Rights

Our attorneys defend individual rights and protect those who cannot protect themselves.

Need Help? Submit a case.